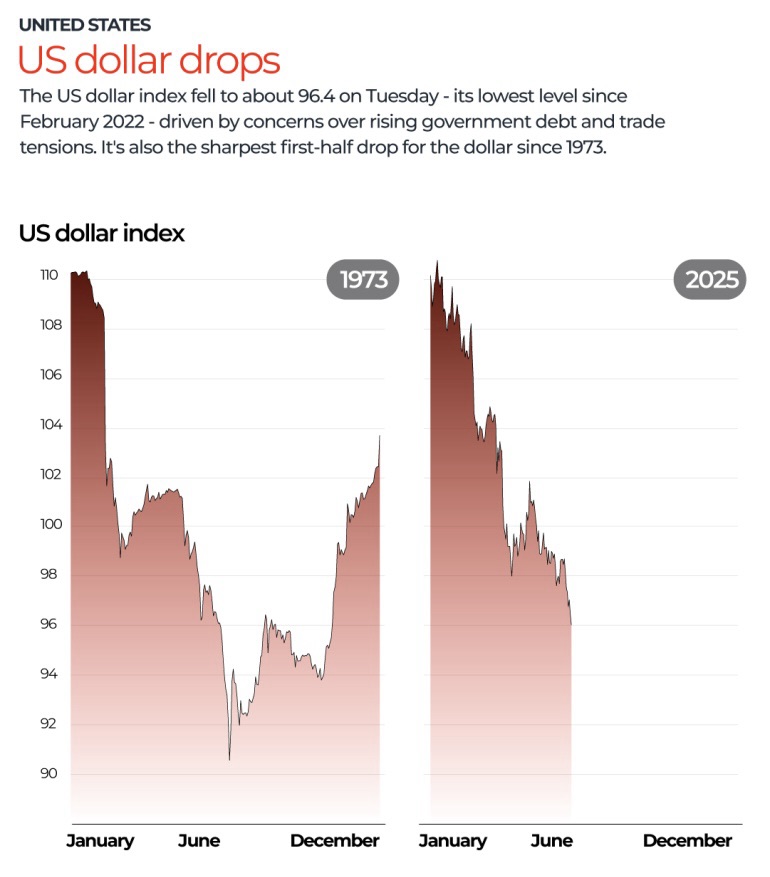

Why is the US dollar falling by record levels in 2025?

Sell-off linked to unpredictable and unfunded economic policies which threaten the safe-haven role of the US dollar

The United States dollar has had its worst first six months of the year since 1973, as President Donald Trump’s economic policies have prompted global investors to sell their greenback holdings, threatening the currency’s “safe-haven” status.

The dollar index, which measures the currency’s strength against a basket of six others, including the pound, euro and yen, fell 10.8 percent in the first half of 2025.

President Trump’s stop-start tariff war, and his attacks that have led to worries over the independence of the Federal Reserve, have undermined the appeal of the dollar as a safe bet. Economists are also worried about Trump’s “big, beautiful” tax bill, currently under debate in the US Congress.

The landmark legislation is expected to add trillions of dollars to the US debt pile over the coming decade and has raised concerns about the sustainability of Washington’s borrowing, prompting an exodus from the US Treasury market.

Meanwhile, gold has hit record highs this year, on continued buying by central banks worried about devaluation of their dollar assets.

What has happened to the dollar?

On April 2, the Trump administration unveiled tariffs on imports from most countries around the world, denting confidence in the world’s largest economy and causing a selloffin US financial assets.

More than $5 trillion was erased from the value of the benchmark S&P 500 index of shares in the three days after “Liberation Day”, as Trump described the day of his tariffs announcement. US Treasuries also saw clear-outs, lowering their price and sending debt costs for the US government sharply higher.

Faced with a revolt in financial markets, Trump announced a 90-day pause on tariffs, except for exports from China, on April 9. While trade tensions with China – the world’s second-largest economy – have since eased, investors remain wary of holding dollar-linked assets.

Last month, the Organisation for Economic Co-operation and Development (OECD) announced that it had cut its US growth outlook for this year from 2.2 percent in March to just 1.6 percent, even as inflation has slowed

Looking ahead, Republican leaders are trying to push through Trump’s One Big Beautiful Bill Act through Congress before July 4. The bill would extend Trump’s 2017 tax cuts, slash healthcare and welfare spending and increase borrowing.

While some legislators believe it could take until August to pass the bill, the aim would be to raise the borrowing limit on the country’s $36.2 trillion debt pile. The non-partisan Congressional Budget Office said it would raise Federal debt by $3.3 trillion by 2034.

That would significantly raise the government’s debt-to-GDP (gross domestic product) ratio from 124 percent today, raising concerns about long-term debt sustainability. Meanwhile, annual deficits – when state spending exceeds tax revenues – would rise to 6.9 percent of GDP from about 6.4 percent in 2024.

So far, Trump’s attempts to lower spending through Elon Musk’s Department of Government Efficiency have fallen short of expectations. And though import tariffs have raised revenue for the government, they’ve been paid for – in the form of higher costs – by American consumers.

The upshot is that Trump’s unpredictable policies, which prompted Moody’s rating agency to strip the US government of its top credit score in May, have slowed US growth prospects this year and dented the demand for its currency.

The dollar has also trended down on expectations that the Federal Reserve will cut interest rates to support the United States’ economy, urged on by Trump, with two to three reductions expected by the end of this year, according to levels implied by futures contracts.

Is the US becoming a ‘less attractive’ destination?

Owing to its dominance in trade and finance, the dollar has been the world’s currency anchor. In the 1980s, for instance, many Gulf countries began pegging their currencies to the greenback.

Its influence doesn’t stop there. Though the US accounts for one-quarter of global GDP, 54 percent of world exports were denominated in dollars in 2023, according to the Atlantic Council.

Its dominance in finance is even greater. About 60 percent of all bank deposits are denominated in dollars, while nearly 70 percent of international bonds are quoted in the US currency.

Meanwhile, 57 percent of the world’s foreign currency reserves – assets held by central banks – are held in dollars, according to the IMF.